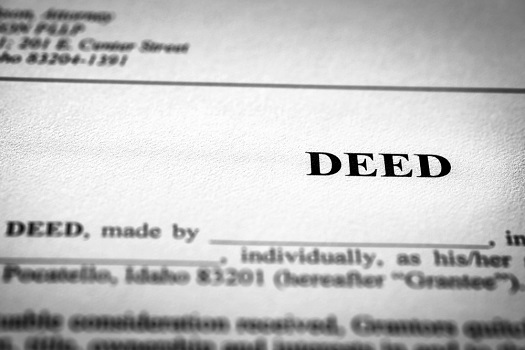

If you’re writing your final wishes planner, you may be wondering what options you can take to effectively distribute all your assets to the rightful heirs. The transfer on death deed should be one of your considered options.

The transfer on death deed is a document highlighting your transfer of ownership to someone else, whether a spouse, child, relative, business partner, or another person when you die. This document can be called in many terms, including “deed upon death” or “beneficiary deed”.

So, why should you establish a transfer on death deed?

- It avoids probate.

You want your estate distribution process to be as simple as possible. The transfer on death deed allows your beneficiaries to own your assets without undergoing the probate process. - It allows the grantor to freely own and use the property until death.

The transfer on death deed doesn’t allow your beneficiaries to own the estate while you are alive. This can lessen disputes over mortgage expenses and other taxes and costs. - It can be passed on to multiple or alternate beneficiaries.

If the initial beneficiary is not present during the transfer of ownership, the second or alternate beneficiary can take over. This can be favorable when the first beneficiary dies before you. - It can be revoked anytime.

You can file for revocation anytime at your country clerk’s office, and you don’t have to obtain the consent of your beneficiary to do so. Estate planning through this document has never been this easy!

Providers of estate planning storage in Chicago, Illinois can also help you make the most out of your assets.

Life Snapshot®, Inc., your dependable digital storage vault in Illinois, offers more for your digital asset management needs. Call us at 312-815-1707!